Section of Family Code in Ca for Failing to Disclose

Annunciation of Disclosure – FAQs

Frequently Asked Questions for Declarations of Disclosure in California

In every unmarried divorce example in California, with the exception of default cases, both litigants must ready and serve a set of forms known as Declarations of Disclosure. These forms are the financial statements that set forth a total disclosure for each party of their respective income, expenses, avails and debts. These forms are extremely of import considering if not done correctly, the political party tin be discipline to severe sanctions in the form of chaser fees or an award of an entire asset to the other political party. The forms are signed under penalty of perjury. Given the importance of preparing accurate documents, and the extreme importance of reviewing these documents to decide whether the other party has been truthful. The set of forms includes the following:

- Declaration of Disclosure (grade FL-140)

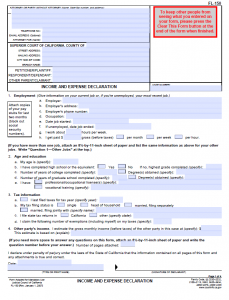

- Income and Expense Declaration (class FL-150)

- Schedule of Assets (class FL-142)

- A proof of service likewise needs to exist filled out and filed with the court (grade FL-141)

The Declaration of Disclosure Appears to be a Simple Form – is information technology every bit Simple as it Looks?

The Announcement of Disclosure appears to be a simple course; however, it is quite important. The form requires a full fiscal disclosure of things that may not exist included on the Income and Expense Declaration and Schedule of Avails and Debts forms.

First, the political party is required to provide the previous two years' tax returns.

Second, the party completing the form is required to provide a argument regarding all cloth facts and information concerning the value of all customs property. This means that if a party has access to whatever documents or other data (which may not be in the class of a document), relating to the value of any joint belongings they must provide all such information to the other party.

Third, the party must provide a statement regarding joint debt. Divorcing parties should make certain to listing out all debts every bit failing to include marital debts is rarely helpful to a party's case.

Finally, the form requires an "accurate" and "complete" disclosure of all investment opportunities that arose during the union. This is an important requirement because it could be broadly construed. For example, if the party was approached during the matrimony to invest in a concern venture, information technology must exist disclosed.

What happens if one party provides a faux Annunciation of Disclosure course?

When a party fails to fully and accurately disclose income, expenses, assets or debts, or fails to disclose business opportunities that arose during the matrimony of the parties, the ramifications can exist quite astringent for the non-disclosing party. For example, the judgment of dissolution of wedlock can be set aside based on fraud and/or the lack of disclosure. The non-disclosing party can be fabricated to pay chaser fees in the form of sanctions. And about severely, the party failing to disclose may lose the entire asset to the other political party.

If you lot doubtable your spouse or ex-spouse did non disembalm an asset or business opportunity, it is imperative that you act immediately. You will want to either bear discovery or file a movement with the court. For a detailed guide about discovery, click here.

What is an Income and Expense Declaration?

How to fill out the Income and Expense Declaration

In order to fill up out the Income and Expense Annunciation, you should assemble the following documents and data:

- Your previous years' taxation return

- Pay stubs for the past ii months and the last pay stub for the previous yr

- Your credit menu statements for the year

- A re-create or data about your bills for the twelvemonth

- A copy of all schedules that were filed with your tax returns

- If you are self-employed:

- A copy of your accounting software

- Profit and loss argument for the electric current year and previous year

- Balance sheet for the current year and previous year

- Corporate or business tax returns

- Documents regarding your investment accounts and other assets

- If you accept rental property, documents showing income and expenses for the twelvemonth-to-appointment and previous year.

Fill out the information required on the sheet as best you tin can. To figure out your monthly income, yous will demand to figure out your annual income and divide by twelve. Most salaried employees are paid every 2 weeks, for which at that place are 26 pay periods per year. Multiply the gross amount yous receive every 2 weeks by 26 and then divide past 12.

Check the box for "estimated" expenses on page 3 of the Income and Expense Annunciation. If you wish to have the court review your "proposed" expenses, we typically see those attached as a separate page or at least clearly identified equally expenses that are proposed rather than an bodily current expense.

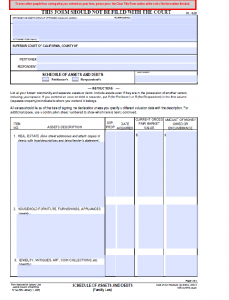

What is a Schedule of Assets and Debts?

How to fill out the Schedule of Avails and Debts

The Schedule of Assets and Debts is one of the most important documents in dissolution of spousal relationship cases. This four-page course requires a consummate list of avails and debts. Approximate valuations must be made. Notably, parties filling out the Schedule of Assets and Debts should take fourth dimension to fill out this documents so information technology is authentic and consummate. The grade is signed under penalties of perjury and if not accurate and complete, the party executing the document could face severe penalties.

Before starting to make full out the form, review all four pages. Note that there are attachments that must exist provided with the Schedule of Assets and Debts. For case, the post-obit documents are required attachments:

- For real property, yous must include a copy of the deed and statements of all mortgages.

- For banking company and investment accounts, you must provide the most current account statement.

- For credit cards, you must provide the most current statement.

- If you are owed money, provide a re-create of the promissory note or other writing evidencing the debt owed to you.

- For life insurance, y'all must provide all the pertinent information including greenbacks value, death benefit, casher, etc.

- For vehicles, you must provide a copy of the title.

- For personal belongings, such as furniture and furnishings and collectibles, y'all take to create an inventory of items.

- If you ain a business, we recommend consulting with an chaser to ensure that the proper information is disclosed. Depending on the type of business, some information may exist confidential and not subject to disclosure under federal or land law, or past the corporation'south rules. For case: Suppose you are a md and own a pocket-size family medicine practice. Y'all are going through a divorce and your spouse wants to know what patients yous have seen in the past twelvemonth. Under federal law, you cannot disclose the names of your patients.

You are also required to provide an gauge valuation of each item that y'all identify on the grade. If you practice non know the value of an item, err on the side of approximating a value that is nearly favorable to y'all. Continue in listen that your Schedule of Assets and Debts will exist scrutinized by the other side and volition be used against you if your valuations are grossly off or have been misrepresented.

For vehicles, use the Kelly Blue Book value.

Should you write down the "character" of property as either carve up or community?

One of the line items in the Schedule of Assets and Debts requires the party to identify the character of property every bit either community property or divide belongings. We caution all of our clients in making an assertion regarding characterization of belongings. If you lot are unsure, write down that the character is unknown or err on the side of label that is almost favorable to you. For example, if you lot own a home merely information technology is titled in your spouse'southward name alone, Exercise NOT write that the marital residence is your spouse's dissever holding simply because information technology is in his or her name solitary.

For more information about the characterization of property, including "mixed character" property that is both customs and separate property, click hither for our holding division guide.

Are the Declaration of Disclosure Forms Filed with the Court?

No. The Declaration of Disclosure, Income and Expense Annunciation, and Schedule of Avails and Debts are all simply served on the other side. Afterwards the documents are provided to the other side past postal service or personal service, a form chosen a Annunciation Regarding Service of Declaration of Disclosure is the only certificate filed to evidence that these documents were given to the other side.

What practice I do if the Opposing Political party Refuses to Provide their Declaration of Disclosure?

If the opposing party in a case refuses to provide their Declaration of Disclosure, yous should "meet and confer" with them by sending a letter requesting that they provide yous with their DODs. If they still neglect to provide them, you can file a motility with the family law trial court asking the courtroom to "strike" the other political party's petition or response, which will so allow you to "default" them and move forward in the case without the other side's participation.

What exercise I do if the Opposing Party's Declaration of Disclosure is Inaccurate?

There are a number of important steps a litigant can take in a divorce or legal separation activity when the opposing party's disclosures are inaccurate. First, you tin need that the other party fix them. 2nd, you can commence discovery to obtain information relating to the DODs, including sending a demand for documents, sending out subpoenas to fiscal institutions, and taking depositions for example. Third, you can do nothing and wait until trial (bold you are able to obtain accurate data concerning the other party'south fiscal condition), and use the fact that the other party provided fake, misleading or inaccurate data against them.

For boosted information most Declaration of Disclosure in Orangish County, contact our part today. We offer a complimentary, individual consultation to discuss what issues you may be faced with in your case. Our office provides costless parking in Irvine, and we accept many clients living in Newport Embankment, Laguna, and Mission Viejo to proper name several areas. Call united states today.

Source: https://www.orangecountydivorce.com/declaration-of-disclosure-faqs/

0 Response to "Section of Family Code in Ca for Failing to Disclose"

Post a Comment